Mistake #3: Cost-Cutting Programs with Incremental Results

- Dr. Marvilano

- Aug 31, 2018

- 7 min read

This blog post is part of the Seven Fatal Mistakes of Cost-Cutting series. Don't have time to read it now? Download the PDF here.

The Problem: Cost-Cutting Programs with Incremental Results

In the pursuit of improved profitability and financial efficiency, many companies resort to cost-cutting initiatives. However, not all cost-cutting programs are created equal, and some fall victim to the perils of incrementalism. These failed programs opt for small, easy-to-implement cost-cutting measures, cutting too little to make a significant impact. As a consequence, they leave a substantial amount of potential profit on the table, failing to achieve meaningful results. In this section, we explore the problem of cost-cutting programs that cut too little and fall short of optimizing their impact.

The Allure of Easy and Incremental Cuts

Cost-cutting programs that cut too little are often characterized by an overemphasis on quick and incremental changes. These initiatives may target low-hanging fruit and opt for minor adjustments to reduce expenses. The allure of easy and quick wins may appeal to decision-makers seeking immediate results, but it can hinder the pursuit of more substantial cost-saving opportunities.

Neglecting Holistic Optimization

The problem with focusing solely on incremental cuts is that it neglects the potential for holistic optimization. By exclusively pursuing small, easy-to-implement measures, companies may miss out on more significant cost-saving opportunities that require a deeper analysis and a broader approach. Failing to consider the bigger picture can result in leaving substantial potential profit untapped.

Overlooking Systemic Inefficiencies

Incremental cost-cutting measures may address symptoms of inefficiency but overlook systemic issues within the organization. Rather than identifying and resolving root causes, these programs may provide temporary relief without addressing the underlying problems. Consequently, the same cost inefficiencies can persist, preventing the company from achieving substantial and sustained savings.

Diminished Competitive Advantage

Cutting too little can have implications beyond the immediate financial impact. By failing to optimize cost structures, companies may miss opportunities to enhance their competitive advantage. Competitors that embark on more comprehensive cost-cutting initiatives could gain a competitive edge by offering products or services at a lower cost or with added value.

Insufficient Response to Market Challenges

In today's dynamic business environment, companies must be agile and responsive to market challenges. Incremental cost-cutting may not be sufficient to adapt to rapidly changing market conditions or industry disruptions. Companies need to be proactive and take a strategic approach to cost optimization to ensure they can weather market uncertainties effectively.

Stagnation of Innovation and Growth

By focusing on incremental cuts, companies may compromise their ability to invest in innovation and growth. Cost-cutting initiatives that prioritize short-term savings without considering long-term growth potential may hinder investment in research and development, new technologies, or market expansion. This stagnation can hinder the company's ability to remain competitive in the long run.

Limiting Employee Engagement and Creativity

Cost-cutting programs that only cut a little can inadvertently limit employee engagement and creativity. Employees may feel that their efforts are being directed toward minor adjustments rather than significant, transformative changes. This can lead to a lack of enthusiasm and creativity in finding new and innovative ways to optimize costs.

Masking the Need for Structural Changes

Incremental cost-cutting can create a false sense of progress, masking the need for more profound structural changes within the organization. Rather than addressing fundamental issues, companies may become complacent with minor cost reductions, failing to recognize the potential for larger gains through more comprehensive restructuring.

The Root Cause: Defensive Stance of Managers

While cost-cutting programs are essential for financial efficiency, many face significant obstacles that hinder their success. Among the various causes of failed cost-cutting initiatives, the number one reason is often the defensive stance of managers who protect their budgets and divisions. This defensive behavior perpetuates the funding of legacy but irrelevant projects, drains precious company resources, and allows inefficient departments to grow despite their lack of strategic relevance. As a result, the company continues to waste money on non-strategic activities, leaving critical initiatives underfunded and compromising the organization's overall financial health. In this section, we explore the root causes of the problem, highlighting the impact of budget defense on the effectiveness of cost-cutting programs.

Managerial Budget Protection

One of the primary reasons for the failure of cost-cutting programs lies in the defensive attitude of managers. In an effort to safeguard their budgets and preserve the resources allocated to their divisions, managers may resist or obstruct cost-cutting measures. This defensive stance can hinder the reallocation of funds to more critical and strategic areas, perpetuating inefficiencies and undermining the overall financial health of the organization.

Funding Legacy and Irrelevant Projects

Budget defense can lead to the continued funding of legacy projects or initiatives that may have lost their relevance over time. Projects that were once crucial to the company's success may no longer align with the current strategic objectives or market conditions. However, due to budget protection, these projects receive funding at the expense of more contemporary and high-priority initiatives.

Drain on Company Resources

When managers prioritize protecting their budgets over cost-cutting, it can lead to a drain on precious company resources. Funding legacy and irrelevant projects divert financial resources away from more strategic and value-generating activities. This misallocation of resources can prevent the organization from investing in critical projects that would contribute to sustainable growth and improved financial performance.

Growth of Inefficient Departments

Budget defense can enable inefficient departments to grow and expand, despite their lack of strategic relevance or value to the company. In some cases, these departments may continue to receive funding without undergoing necessary scrutiny or evaluation. As a result, resources may be misused or underutilized, further exacerbating the inefficiencies within the organization.

Compromise of Strategic Investments

The defensive protection of budgets can impede the funding of strategic investments and critical activities. When financial resources are allocated to non-strategic or outdated projects, there is limited funding available for essential initiatives that could drive competitive advantage and long-term success. This compromise of strategic investments can hinder the company's ability to adapt to market changes and position itself for growth.

Lack of Cost Accountability

Budget defense can also lead to a lack of cost accountability within the organization. When managers focus on protecting their budgets rather than optimizing costs, there may be a lack of scrutiny and oversight over spending. This lack of accountability can result in wasteful spending and prevent the identification of cost-saving opportunities.

Resistance to Change and Innovation

The defensive behavior of managers can foster resistance to change and innovation within the organization. When budget protection takes precedence, there may be limited openness to new ideas or willingness to challenge existing practices. This resistance to change can hinder the implementation of cost-cutting measures and impede the organization's ability to adapt to evolving market conditions.

Suboptimal Resource Allocation

Ultimately, budget defense can lead to suboptimal resource allocation. Instead of allocating resources based on strategic priorities and value generation, resources may be distributed based on historical budgetary considerations. This suboptimal allocation can prevent the company from fully leveraging its resources to maximize its potential and achieve sustainable growth.

The Solution: Embrace Zero-Based Budgeting

To overcome the challenges of budget defense and achieve meaningful cost reductions, companies need to adopt an aggressive approach that leaves nothing sacred and challenges every cost bucket. An effective strategy to achieve this is through implementing Zero-Based Budgeting (ZBB). With ZBB, companies start with a blank slate, where every expense must be justified with a clear strategic reason. Nothing is budgeted unless it aligns with the organization's strategic objectives, and historical legacy practices are no longer sufficient grounds for funding. In this section, we explore the key recommendation of embracing Zero-Based Budgeting as an aggressive approach to optimize cost-cutting.

Starting from Ground Zero

The core principle of Zero-Based Budgeting is starting from ground zero, with no preconceived assumptions about expenses. Instead of relying on previous budgets or incremental adjustments, companies begin the budgeting process with a fresh perspective. Every cost item must be evaluated independently, and its alignment with the company's strategic goals is thoroughly assessed. This approach forces managers to challenge the status quo and eliminates budgetary inertia that can result from traditional budgeting practices.

Scrutinizing Every Cost Bucket

Under ZBB, every cost bucket is scrutinized, no matter how large or small. There are no sacred cows, and no expense is exempt from examination. By analyzing each cost item, companies can identify inefficiencies, eliminate waste, and redirect resources to areas that deliver the most value. This level of scrutiny ensures that financial resources are allocated to activities that directly contribute to the company's strategic objectives.

Aligning Spending with Strategic Priorities

The key question that drives Zero-Based Budgeting is: "Is there a clear strategic reason to spend this money?" Rather than relying on historical justifications or "business as usual," ZBB requires a strong rationale for every budgeted expense. This alignment with strategic priorities ensures that financial resources are directed towards initiatives that advance the organization's long-term goals, fostering sustainable growth and competitive advantage.

Cultivating a Cost-Conscious Culture

Implementing ZBB necessitates a cost-conscious culture throughout the organization. All employees, from frontline staff to senior management, must be actively engaged in the budgeting process. By involving individuals who are closest to the operations, companies can tap into valuable insights and identify potential cost-saving opportunities. A cost-conscious culture encourages continuous improvement and empowers employees to challenge inefficiencies and propose innovative solutions.

Enhancing Financial Accountability

Zero-Based Budgeting enhances financial accountability within the organization. With each expense requiring justification, there is a heightened sense of responsibility for resource allocation. Managers are incentivized to make data-driven decisions, promoting transparency and discipline in financial management. This heightened accountability helps prevent wasteful spending and ensures that resources are used efficiently.

Fostering Flexibility and Adaptability

The ZBB approach fosters flexibility and adaptability in resource allocation. As market conditions and strategic priorities evolve, companies can quickly reallocate funds to high-impact initiatives. The dynamic nature of ZBB allows companies to respond rapidly to changes in the business environment and seize new opportunities as they arise.

Prioritizing Value-Added Activities

By challenging every cost item, Zero-Based Budgeting allows companies to prioritize value-added activities and eliminate those that do not contribute meaningfully to the organization's goals. This focus on value ensures that resources are invested in projects and initiatives that drive the most significant return on investment and enhance the company's competitiveness.

Driving Continuous Improvement

ZBB is not a one-time exercise; it is a continuous process of improvement and optimization. Companies that embrace Zero-Based Budgeting continually seek opportunities to optimize costs and enhance financial efficiency. This culture of continuous improvement empowers companies to remain agile and adapt to changing market dynamics effectively.

NOTE

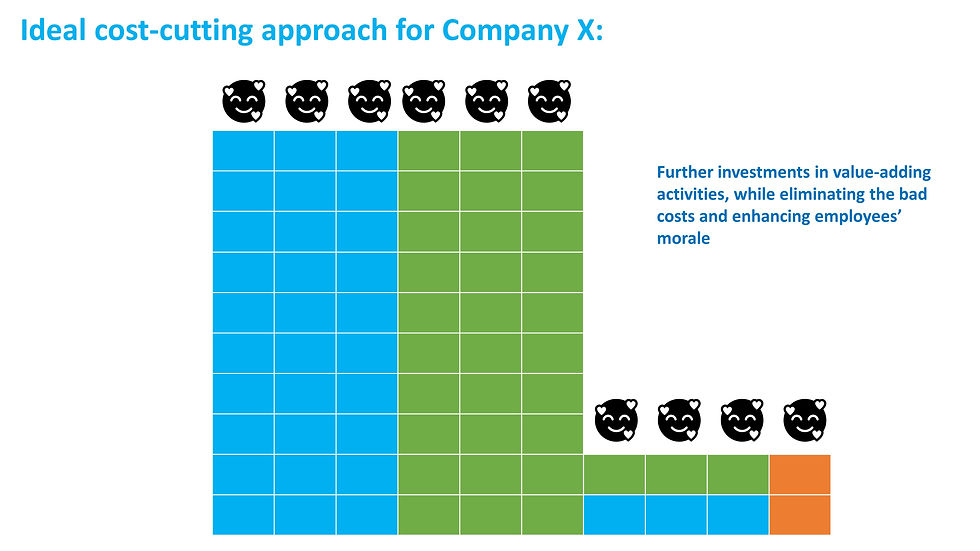

Having examined the visuals of misguided cost-cutting decisions, it is essential to understand what the ideal approach should look like. The visual below illustrates the key elements of an effective cost-cutting strategy:

Comments